Strong Q3 for smartphones, but PC sales decline

Smartphone shipments were robust between July and September, powered by emerging market growth

By Jacob Schindler

Sisvel Insights Market Data Digest is a regular feature aggregating commercial information from the major SEP licensing verticals. Our goal is to provide patent licensing executives with a grasp of the commercial and competitive dynamics in the market for connected devices. The digest exclusively draws on publicly-available information from third parties, all of which is available at its original source via links. Verticals with extensive data available (such as smartphones) will be covered every quarter. Other sectors will be covered as and when new data is published.

The third quarter was largely positive for connected devices, with smartphones looking especially resilient. Market share among the top brands has remained fairly stable, but the coming roll-out of AI integration could shake things up into 2025. In emerging markets like India, consumers are upgrading to more premium devices and 5G is finally becoming entrenched.

We also look at the PC segment, which saw strong demand in the United States despite contraction in the rest of the world. Elsewhere, a pair of reports looking at long-term prospects for IoT connectivity project rapid growth for 5G RedCap, while LPWAN is set to remain a major piece of the puzzle.

Cellular IoT: Strong growth forecast for LPWAN and 5G

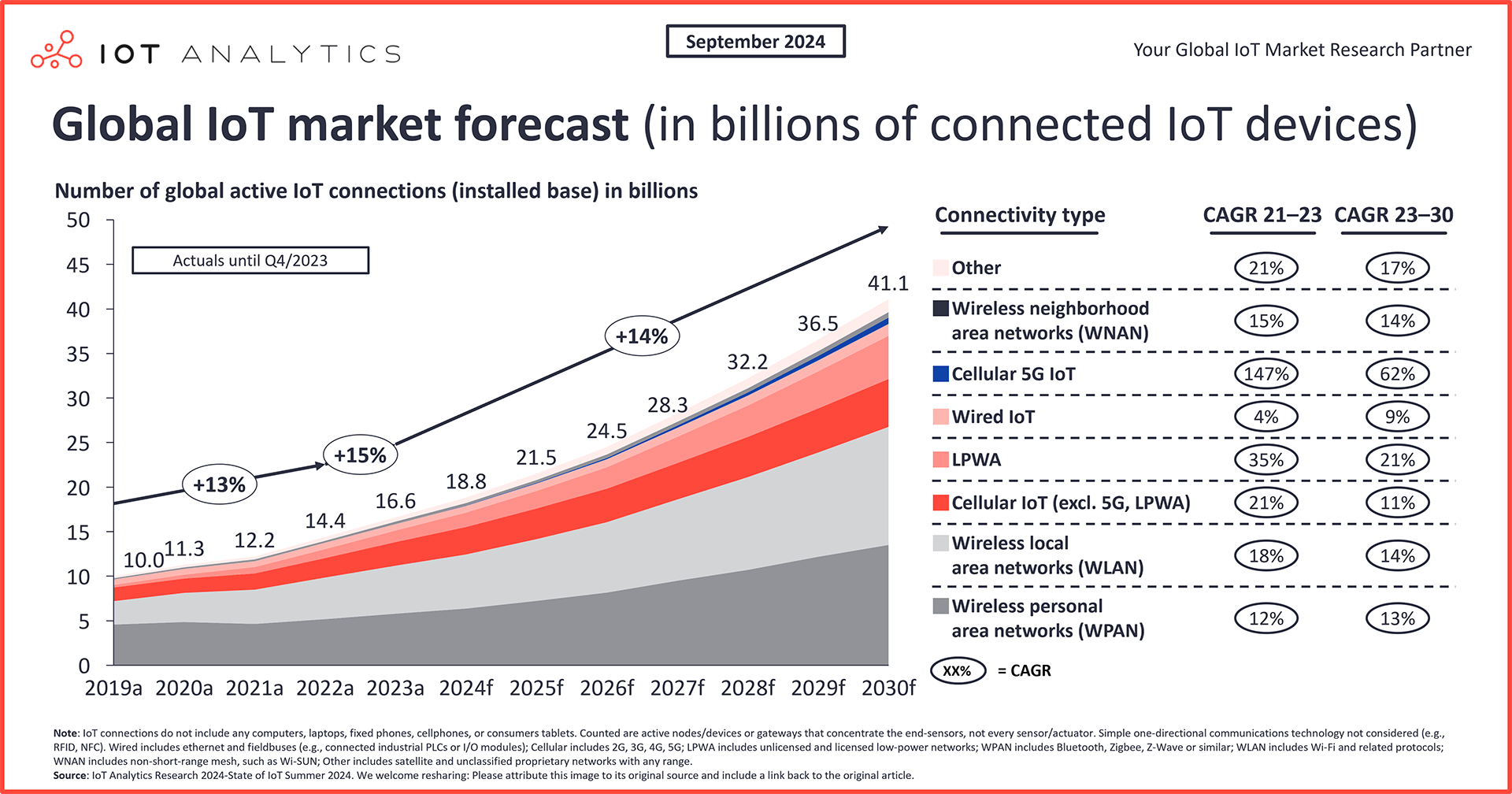

IoT Analytics published its State of IoT 2024 report, breaking down expected CAGRs from 2023-2030 across eight broad categories of connectivity technology. Through the end of the decade, the fastest grower is expected to be 5G. The second-fastest, building from a much larger base, is forecast to be LPWAN (which includes NB-IoT and LTE-M, in addition to unlicensed spectrum solutions).

WPAN (which includes Bluetooth) and WLAN (which includes Wi-Fi) will continue to account for the majority of IoT connections at decade’s end, the report predicts.

Image source: Number of connected IoT devices growing 13% to 18.8 billion

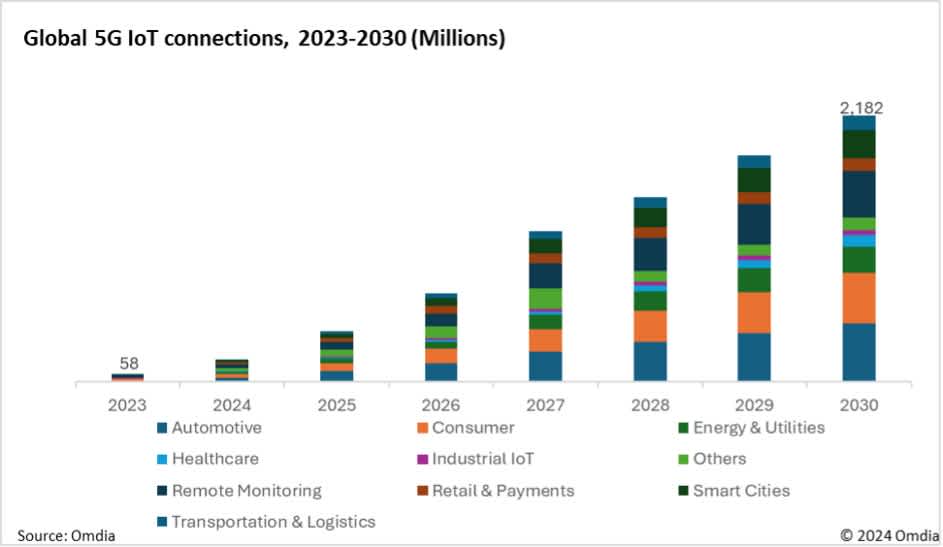

Meanwhile, Omdia has released an aggressive growth forecast for 5G RedCap, calling for over 963 million connections by 2030. Analysts expect RedCap, which saw its first modules hit the market just a year ago, to gradually replace LTE Cat-1 to Cat-4 devices. The use cases, as illustrated in the chart below, will be fragmented among many verticals.

Image source: Omdia predicts explosive growth for 5G RedCap connections set to reach almost 1 billion by 2030

Tablets continue recovery

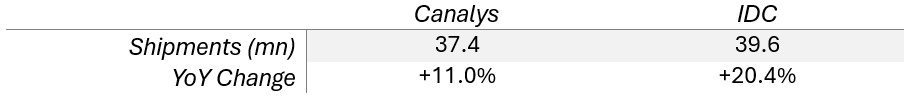

Global tablet shipments grew both sequentially and year-on-year, as retailers took stock ahead of the holiday season. Low baselines from 2023 have helped this market look good in recent quarters, but IDC, which reported particularly strong growth, also noted growing optimism among producers.

Apple remains the market share leader by a good margin. The growth story in this segment is the rise of the rest. Xiaomi and Huawei are closing particularly fast. Leaderboards are available at the links below.

Q3 2024 Global Tablet Shipment Data by Provider

PCs contract, but US market is strong

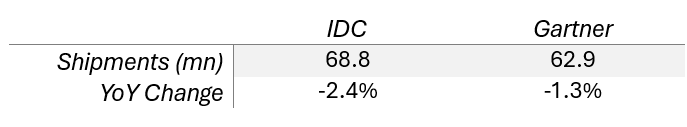

The PC market weakened in Q3, with between 60 and 70 million laptop and desktop computers shipped globally.

Despite some significant differences in measured shipments, both IDC and Gartner continue to portray a two-tiered market, with Lenovo, HP and Dell in the top flight, and the triple-A lineup of Apple, Acer and Asus remaining a cut below.

According to Gartner’s regional breakdown, China is a drag on the segment, having recorded a 10% YoY pullback during the quarter as belt-tightening in the government and SOE sectors continued. The US is a bright spot, with 5.6% growth – the Taiwanese duo of Acer and Asus are the fastest-growing brands there.

PCs with AI chip integration have not yet made an impact. Instead, entry-level offerings are driving demand.

Q3 2024 Global PC Shipment Data by Provider

Global smartphones: All eyes on AI

The smartphone market has waited several years for a good third quarter, and this is it. Canalys declared it the best Q3 since 2021, while Counterpoint says this was the only Q3 with positive growth since 2018.

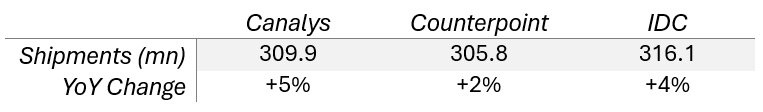

Q3 2024 Global Smartphone Shipment Data by Provider

Source data: Canalys | Counterpoint | IDC

The overall smartphone market has now seen four straight quarters of consensus gains, although the rate of growth has moderated. Emerging markets are helping to drive shipments, but increased component costs are straining profitability of entry level products.

For that reason, brands are looking eagerly to AI features to fuel interest in premium models. Counterpoint reports that one in four consumers who buy a smartphone in 2024 will spend at least $600, an encouraging sign.

The rollout of Apple Intelligence is being closely watched. Together with the launch of the iPhone 16 series in September, it appears to be driving upgrades from older models. This helped Apple grow during the quarter, while Samsung contracted slightly.

Samsung and Apple are followed by the Chinese trio of Xiaomi, Oppo and Vivo. Vivo was the standout performer of the quarter, with over 20% annual growth on the back of strong sales in Southeast Asia. Further down the table, Counterpoint names Motorola and Huawei as the biggest winners, posting 30% year-on-year gains.

China smartphones: Apple bounces back

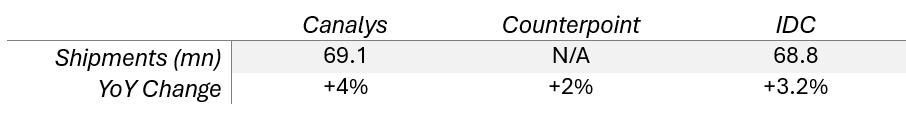

Smartphone sales are strong in China, and the market is poised to post full-year growth for the first time in five years, per Counterpoint. It’s a good sign in an economy that has struggled with weak consumer demand.

Apple made global headlines by falling out of China’s top five last quarter. In Q3, the launch of iPhone 16 propelled the Cupertino company back to the top tier, although it did contract year-on-year. Still, the outlook is challenging. Apple Intelligence is not yet available in mainland China, which may give the company’s Android rivals a chance to get ahead.

Vivo remained China’s largest smartphone brand by consensus. The data providers also agree that Huawei was the fastest-growing vendor in Q3. Meanwhile, Oppo and Huawei offshoot Honor were among those who lost ground during the quarter.

Q3 2024 China Smartphone Shipment Data by Provider

Source data: Canalys | Counterpoint | IDC

India smartphones: Big rebound and highest-ever value

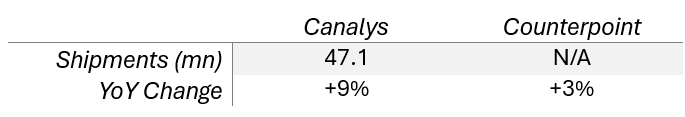

Canalys reported 9% growth for Indian smartphone shipments in Q3, a strong recovery from a sluggish second quarter. Counterpoint added that the total value of smartphone sales in the country hit its highest-ever level as consumers continue to ascend the price curve.

Vivo remained India’s favourite smartphone brand, with over 19% market share. Xiaomi, Samsung, Oppo and Realme round out the top five.

The key growth driver of this market heading into 2025, according to Canalys analysts, will be 5G-capable devices at ultra-low price points. 5G is becoming firmly entrenched, accounting for 81% of Q3 shipments.

Q3 2024 India Smartphone Shipment Data by Provider

Source data: Canalys | Counterpoint

Africa smartphones: Transsion remains king

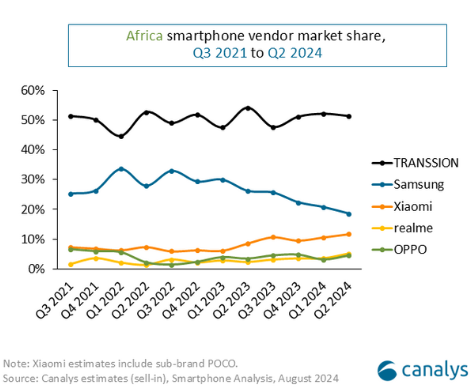

Canalys published a report on African smartphone shipments through Q2, showing emerging market specialist Transsion still firmly in control. But other Chinese brands, notably Xiaomi, Realme and Oppo, are picking up some momentum as Samsung continues to lose market share.

Overall market growth was 6%, but shipments totalled just 17.8 million units. There is significant divergence across regions and economies. North African markets like Algeria and Egypt are surging, while growth in major Sub-Saharan markets ranges from modest (5% in Nigeria, the continent’s largest market by volume) to non-existent (a 22% pullback in Kenya).

Image source: Canalys Newsroom - African smartphone market expands modestly by 6% amid economic headwinds

Jacob Schindler is Sisvel's Senior Content & Strategic Communications Manager