Uncertainty for smartphone & PC markets despite a positive 2024

Shipments data for last year was encouraging, but 2025 poses plenty of questions around AI, trade and consumer confidence

By Jake Schindler

The shipments numbers for connected devices in 2024 are in, and personal electronics sales generally rebounded during the year. That’s positive for patent owners with major OEMs in these verticals under licence. But the period between January 1 and Lunar New Year has surfaced some big questions for the year ahead.

Trade is an obvious one. US tariff activity – at least toward China – so far looks more muted than some expected. Now, from out of left field, comes talk of tariffs against Taiwanese-made semiconductors. This raises the spectre of supply chain issues that threw so many product markets off kilter during the Covid period.

Another question is around AI. PC and smartphone makers are banking on AI features to encourage device upgrades and differentiate higher-end models. The recent release of DeepSeek R1 model has shattered assumptions about how much computing power will be needed to run top-of-the-line, large language models. Will the narrative be rewritten – and if so, in which direction?

Finally, there will be questions about consumer confidence. Much will depend on what happens with the trade and AI stories, and how they impact US equities and global consumer prices. In China, subsidies for smartphones and tablets were recently rolled out to encourage wary consumers to trade in old devices. It’s a welcome stimulus for brands but underscores the continued sense of fragility.

Let’s look at the market data for the fourth quarter and full year 2024.

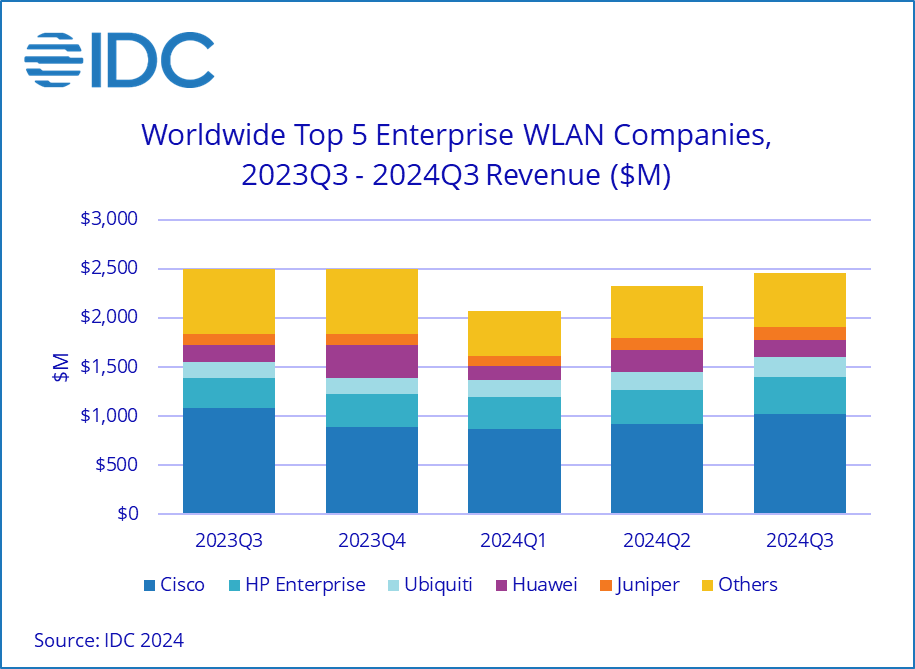

Wi-Fi 6 and 7 gain traction in enterprise access points

The newest versions of the Wi-Fi standard are seeing greater deployment in the enterprise networking market. According to an IDC report released in December, most dependent access points use Wi-Fi 6 or newer technology. The more advanced Wi-Fi 6E grew to 31.7% of the market by revenue in Q3 2024, while Wi-Fi 7 is still a blip on the radar at 4.9%.

Across geographies, enterprise WLAN is seeing encouraging sequential growth – although revenues are still down compared to a strong 2023. Cisco is the biggest player in this space, followed by HP Enterprise, Ubiquiti and Huawei.

Image source: IDC

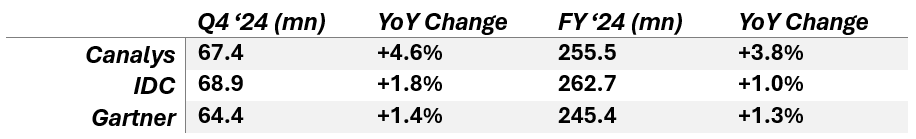

PCs on uptrend as vendors prepare for Windows 10 sunset

Shipments of PCs grew in Q4. Canalys delivered the most bullish read on the market, reporting 4.6% growth for the quarter and 3.8% for the year. IDC and Gartner, on the other hand, pegged both quarterly and full year growth in the sub 2% range.

Both Canalys and IDC highlighted the impact of government subsidies in China and end-of-year promotions in the US and Europe. The market is expected to accelerate in 2025 as businesses prepare for the end of Windows 10 support in October 2025.

There is consensus among data providers on the pecking order in this market: Lenovo maintained its top position, followed by HP and Dell. Apple and Asus rounded out the top five. For the full year, HP and Dell lost ground – if only very slightly – while the remaining big players generally grew volumes.

Q4 & FY 2024 Global PC Shipments

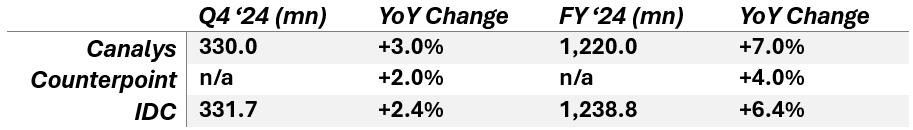

Intense competition in global smartphone market

It was a strong year of growth in smartphone shipments globally. Canalys, Counterpoint and IDC each reported upwards of 1.2 billion device shipments in 2024, representing full-year volume growth of between 4% and 7%. That reversed two years of decline for the market, in Counterpoint’s reckoning.

Per Canalys’ numbers, Apple led the market with a 23% share, driven by strong performance in emerging markets like India and Southeast Asia. Samsung followed with a 16% share, while Xiaomi maintained its third position with 13% market share, achieving the highest growth among the top three vendors. Transsion and Vivo rounded out the top five.

Both Canalys and IDC noted that Chinese vendors, particularly Xiaomi, Transsion, and Vivo, drove much of the growth by focusing on low-end devices and achieving rapid expansion in emerging markets. Apple and Samsung, while maintaining their top positions, saw declines in market share as competition from Chinese brands intensified.

Q4 & FY 2024 Global Smartphone Shipments

Image source: Counterpoint

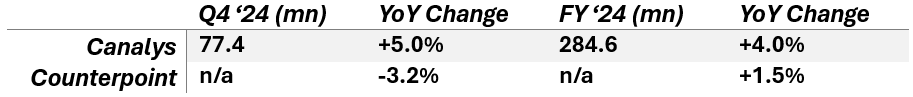

China smartphones: Vivo takes top spot for 2024

Data providers differ somewhat on how China’s smartphone market is faring. Counterpoint reported a sales decline for Q4 and modest 1.5% growth for the full year; Canalys saw a quarterly shipments boost of 5%, capping off a year of 4% growth.

Either way, 2024 brought a welcome rebound from the contraction a year earlier. Although things are trending in the right direction, Chinese consumers remain cautious. It’s notable that low-cost brand Vivo is wearing the crown in this market.

Huawei had an excellent year to take the silver medal for 2024 by consensus. Counterpoint placed it #1 for Q4 on the strength of its Mate 70 series launch, giving Huawei its first quarterly win since US sanctions hobbled its smartphone business.

A bright spot for all players: in January the Chinese government announced plans to subsidise trade-ins of smartphones and other personal devices in its latest bid to boost consumption.

Q4 & FY 2024 China Smartphone Shipments

Indian smartphone buyers go premium

India continues to be a source of growth. Budget devices have long been dominant, but premium brands like Apple and higher-end Chinese handsets are gaining ground. One key driver is the ongoing rollout of 5G services, which is prompting upgrades to 5G-equipped devices.

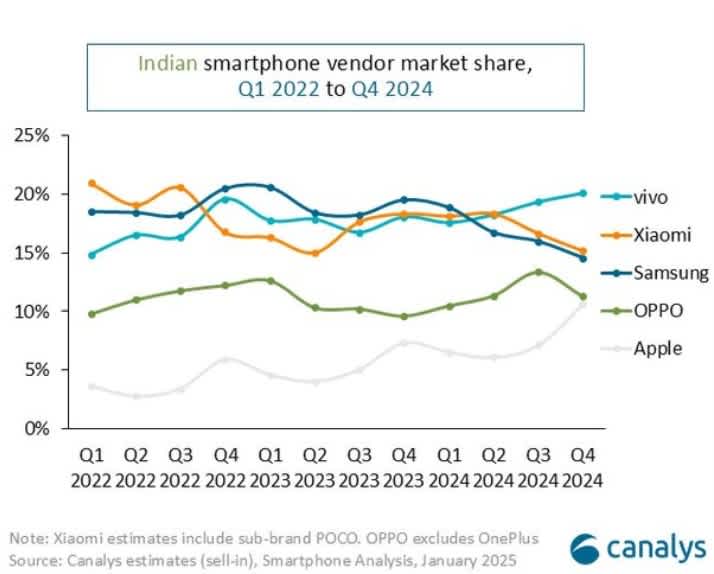

India's smartphone market grew by 5% in 2024, reaching 155.9 million shipments, according to Canalys. Vivo maintained its top position with a 20% market share, followed by Xiaomi and Samsung. Apple entered the top five for the first time, driven by aggressive promotions in the country.

Image source: Canalys

Sisvel Insights Market Data Digest is a regular feature aggregating commercial information from the major SEP licensing verticals. Our goal is to provide patent licensing executives with a grasp of the commercial and competitive dynamics in the market for connected devices. The digest exclusively draws on publicly-available information from third parties, all of which is available at its original source via links. Verticals with extensive data available (such as smartphones) will be covered every quarter. Other sectors will be covered as and when new data is published.